does doordash do quarterly taxes

Uber is offering a guarantee of 500-1000 if you sign up and do 50-200 rides within 30 days offers vary based on location How does Ubers new driver guarantee currently work. Youll make 200-300 a day easily.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

As an independent contractor you can knock the standard mileage deduction of 56 cents per mile 2021 or 585 cents in 2022 from your revenue.

. January 15 2022 was the deadline for quarterly payments on income earned from September 1 to December 31. Stick to hours ranging from 10-3pm and 5-10pm. Add your Independent Contractor profits to other income to determine your income tax bill.

If you work for yourself and have a regular job you can help avoid underpayment penalties by adjusting your W-4 withholding at your day job. By clicking Accept All Cookies you agree to the storing of cookies on your device to enhance site navigation analyze site usage and assist in our marketing efforts. Reply to me if you need more info on it.

Copies of our Annual Report on Form 10-K Quarterly Reports on Form 10-Q Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13a or 15d of the Exchange Act as amended are available. Guaranteed 1000 for completing your first 50 Uber rides in 60 days. Knowing how many miles you drove means a smaller tax bill.

To work for DoorDash you must own a car or bicycle have a clean driving record be over 18 have at least 2 years of driving experience and an outgoing attitude. Taxation system requires that self-employed workers make estimated tax payments on a quarterly basis -- if they owe 1000 in taxes for that year that is if its less than 1000 they can wait until filing their tax return to settle what they owe for the year. Dashing can be a career.

Doordash earnings impact our income taxes differently than self-employment taxes do. Claiming common credits like the Earned Income Tax Credit EITC the Child Tax Credit and the American Opportunity Tax Credit was all easy to do. Does California Conform To The Exclusions For Other Sba Loan Forgiveness Or Grants.

Quarterly estimated taxes Again an employee-employer comparison is helpful here. When are quarterly taxes due in 2022. Wolts cash working capital indebtedness transaction expenses certain pre-closing taxes the establishment of an indemnity escrow fund and if applicable the establishment of a true-up escrow fund.

Heres an example of an Uber driver bonus. Even if you. As mentioned the pay-as-you-go US.

Uber is a is two-sided marketplace a platform business model that connects drivers and riders with an interface that has elements of gamification that makes it easy for two sides to connect and transactUber makes money by collecting fees from the platforms gross bookings. My acceptance rate is always under 50 but im making bank so who cares. How To File Taxes Doordash.

DoorDash has partnered with Wealthsimple to offer Canadian Dashers exclusive deals for tax filing and investing. Terms of conversion are set forth in the Share Purchase Agreement and include customary adjustments for eg. As a self-employed person youll pay as you go too just on set dates four times a year.

Remember to pay the iRS quarterly taxes. After you file you can decide to pay what you want for the filing service including 0. Tax Filing Join over a million Canadians who use Wealthsimple Tax to file their taxes safely securely and easily.

Refer someone to DoorDash and receive 5 in credit after they make their first purchase. The good news was the business continued to generate strong growth with revenue rising 35 year over. The FTE average yield on all earning assets non-GAAP decreased 77 basis points in prior year quarterly comparison from 384 for the first quarter of 2021 to 307 for the first quarter of 2022.

What Are The Proposed Changes To Capital Gains Tax. In 2021 Uber generated over 174 billion in revenues mostly coming from mobility. First thing lets clarify.

Food delivery company DoorDash DASH-645 released its latest quarterly results on May 5. There isnt really a category of taxes for DoorDash but we know that a lot of Dashers refer to their tax responsibilities as DoorDash taxes so weve used that term. Generally the IRS expects tax payments quarterly with due dates of April 15 June 15 September 15 and January 15.

These estimates are based on several estimates and. Thats important to know. So if you use your PPP loan to pay your business taxes that amount wont be forgiven.

Set your own hours and earn up to 20hour. If a due date hits a weekend or holiday the payment is due the next business day. Post was informative on the mileagepay info on how you should accept or decline orders.

Whether youre new to DoorDash taxes or have a few tax filings under your belt HR Block is here to help Dashers navigate tax time. Testing revealed only a few drawbacks. Employers typically withhold taxes from employee paychecks each period so taxes are paid as the year goes on.

October 15 2021. If Doordash doesnt do this or do it well then its up to you. The software also made it easy to square away pre-refunded credits such as the Advanced Child Tax Credit and pre-paid taxes such as quarterly tax estimates.

How To Calculate Quarterly Taxes. Doordash does not track mileage for you. Each tax year is divided into four payment periods.

Compared to income taxes self-employment taxes are straight forward. Heres where you can find those estimated tax payment. You can read more about how self-employment taxes work for Doordash drivers here.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Much Do People Actually Make From Gigs Like Uber And Airbnb Sharing Economy Financial Aid For College Financial Aid

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

How Does Doordash Make Money Doordash Business Model In A Nutshell Fourweekmba

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

How Do I File Doordash Quarterly Taxes Due Septemb

2021 Update How Much Do Doordash Drivers Make Gridwise

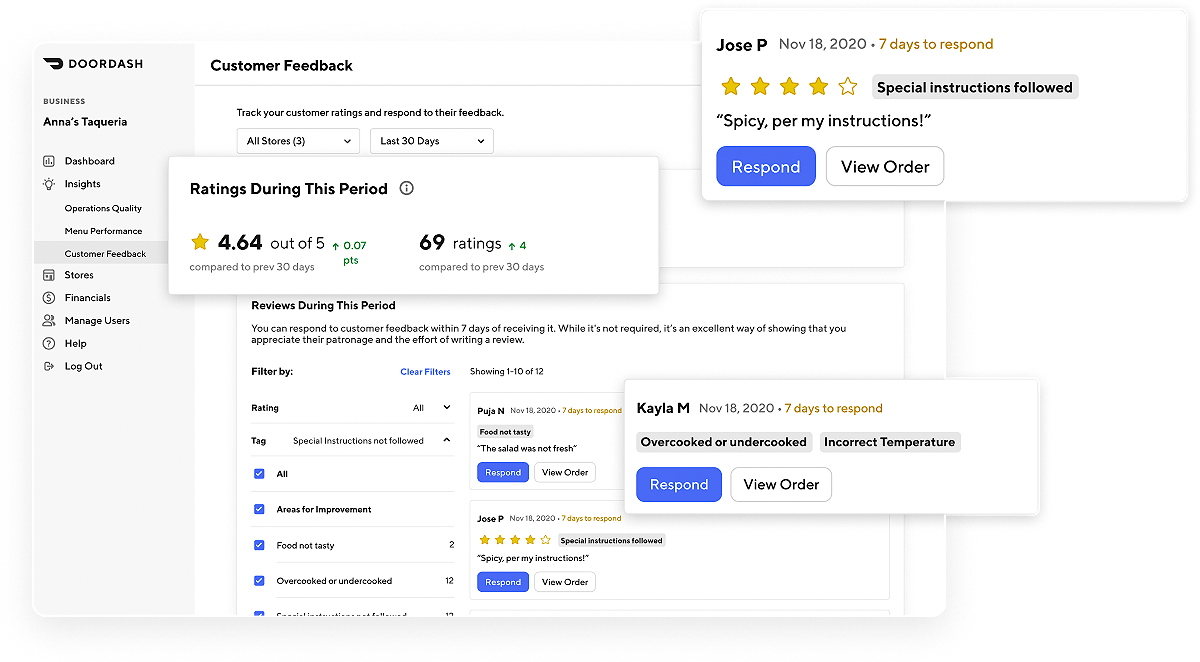

Technology To Manage Your Doordash Store Doordash For Merchants

How Much Money Can You Make With Doordash Small Business Trends Business Tax Deductions Improve Your Credit Score

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

How Many People Use Doordash In 2022 New Data